Financial Data

Trends in Financial Indicators (graphs)

Trends in Financial Indicators (graphs)

<Financial Results>

- ・Net sales(consolidated/non-consolidated)

- ・Operating profit(consolidated/non-consolidated)

- ・Ordinary profit(consolidated/non-consolidated)

- ・Net Income(consolidated/non-consolidated)

<Safety>

-

・Capital adequacy ratio(consolidated/non-consolidated)

[Capital adequacy ratio = Shareholders' equity/Total assets]

Graph showing the ratio of shareholders' equity (net assets) to total assets.

A high equity ratio is considered indicative of financial health.

- ・Interest-bearing Debt

<Profitability>

-

・Free Cash Flow(consolidated)

[Free Cash Flow = Cash flows from operating activities + Cash flows from investing activities]

This can provide for new business investment, return to shareholders, and repayment of interest-bearing debt.

<Efficiency>

-

・Return on total assets (ROA) (consolidated)

[ROA=Business profit [Ordinary profit + Interest expense] / Total assets [Beginning and ending balance average]]

Indicates company efficiency at using all assets to increase profit (business income).

Note: At Kansai Electric Power, "business income" is considered ordinary income before interest and is assumed to indicate regular business profits.

-

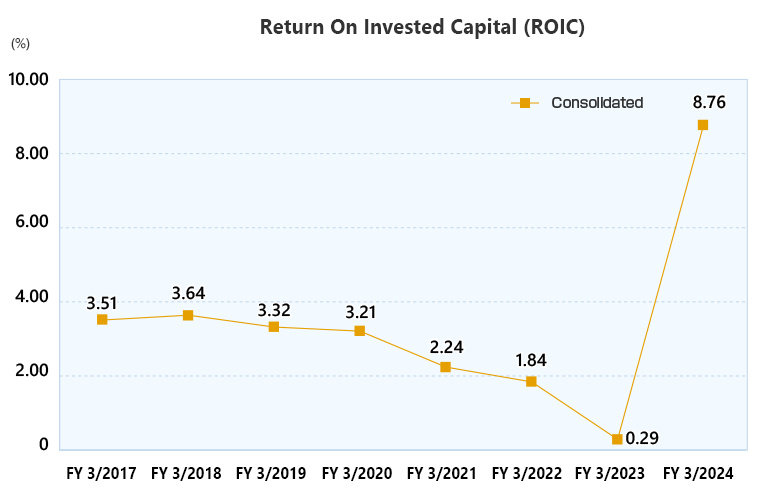

・Return On Invested Capital(ROIC)(Consolidated)

[ROIC=Business profit after tax / Invested capital[Beginning and ending balance average]]

[It shows how efficiently the company is making a profit (business profit) relative to its invested capital.]

-

・Rate of return on equity(ROE)(consolidated)

[ROE=Net income / Equity [Beginning and ending balance average]]

Indicates ratio of net income for current term to total equity (total assets) of the company.

-

・Total Assets(consolidated/non-consolidated)

- ・Capital Expenditures(Consolidated)

<Investment Indicators>

-

・Book Value per Share (BPS)(consolidated/non-consolidated)

[BPS = Book value (shareholders' equity)/Total number of shares issued]

Total equity divided by number of shares issued.

-

・Earnings per Share (EPS)(consolidated/non-consolidated)

[EPS = Net income/Shares of common stock issued]

Net income divided by the number of shares of common stock issued.

-

・Dividend Yield

[Dividend Yield = Cash dividend per share/Share price at end of fiscal year]

Indicates ratio of cash dividend to share price.

-

・Price Earnings Ratio (PER)(consolidated)

[PER = Share price at end of fiscal year/Net income per shar]

Share price divided by net income per share indicates whether the share price is high or low relative to profitability.

-

・Price Book-Value Ratio (PBR)(consolidated)

[PBR = Share price at end of fiscal year/Equity per share]

Share price divided by equity per share indicates whether the share price is high or low relative to asset.